Football in Saudi Arabia

Saudi Arabia has been the focus of the global footballing world for the past few months but football is nothing new to Saudi Arabia.

Riyadh-based Al Hilal are the most successful team in Asian Champions League history. In 2022, Saudi Arabian clubs ranked top in the Asian Football Confederation’s (AFC) Club Competition Rankings1.

The Saudi U16 national team were the first Asian men’s team to win any FIFA tournament (the 1989 U16 World Cup). In 1986, the Saudi men’s team became only the second Arab team in history to reach the Round of 16 of a World Cup. They have won the AFC’s Asian Cup three times and have competed in the last two FIFA World Cups, famously causing Argentina to stumble on their route to victory in Qatar 2022.

Modern Saudi Arabia has a young, rapidly growing population that is football-obsessed. There has been a top-level football league in the country for 47 years, but the founding of the Saudi Professional League (SPL) in 2007 marked the professionalisation of football in Saudi Arabia. The league’s annual highlights are the fiercely contested matches between Al-Hilal and At-Ittihad, which are often referred to as ‘Saudi El Clasico’.

The nation is assertively enacting its Vision 2030 plan to diversify the Saudi economy away from its dependency on oil and develop the country as a sporting hub. Supercharging the SPL is the latest step in this strategy, which has previously seen the Public Investment Fund (PIF) invest in the Premier League via Newcastle United, the PGA Tour, esports, and many more sports-related companies. Sport is central to its strategy due to the outsized global attention it attracts and a focus on public health initiatives in the country, in which around 60% of the population is classified as overweight or obese.

Where is the SPL today

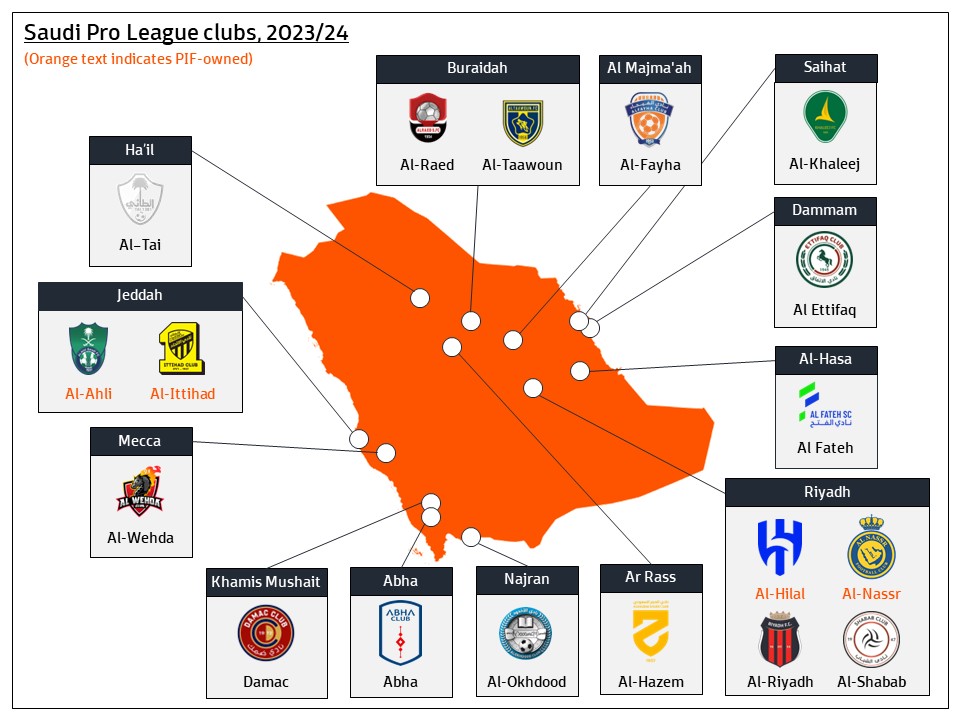

The SPL runs parallel to the European domestic season. For the 2023/24 season, the league will feature the 18 teams shown in the graphic below, up from 16 teams in the previous season.

Broadcast and sponsorship revenue

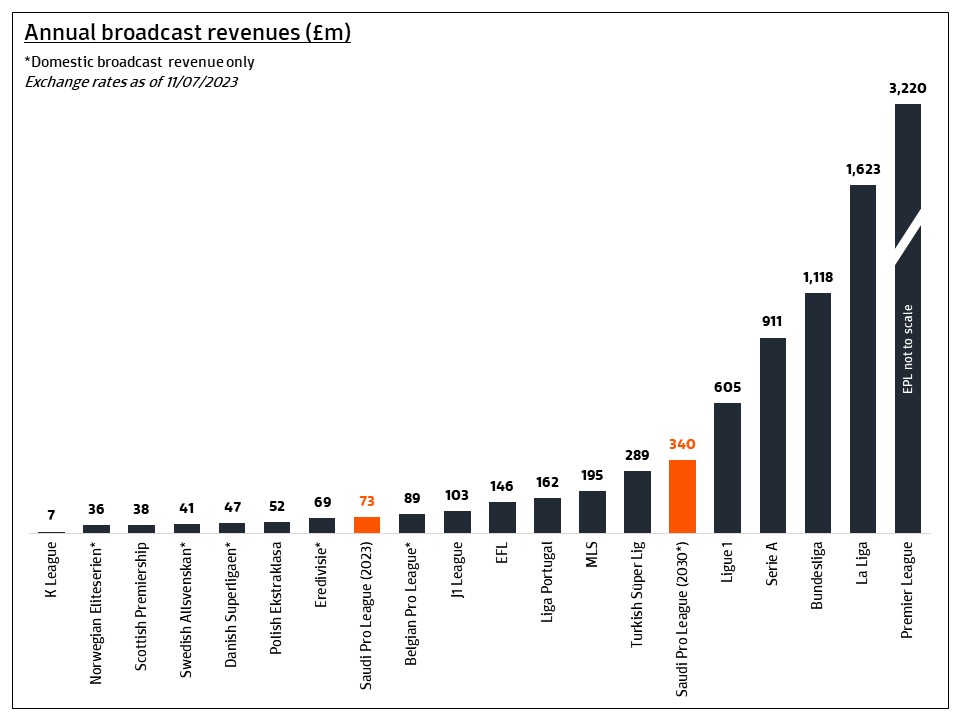

The SPL’s domestic broadcast rights are held by state-owned Saudi Sports Company which is paying c.£63m2 per season through to the end of the 2024/25 season. International rights deals are currently reported to be generating less than £10m3 per season. Broadcast contributes around two-thirds of the SPL’s £94m4 total revenue, with the remainder coming from the league’s title sponsorship deal with real-estate developer Roshn, reported to be worth around £20m4 annually.

Annual broadcast revenues of £73m are comparable to Netherlands’ Eredivisie (£69m, domestic only) and Belgium’s Pro League (£89m, domestic only). The SPL is currently the second-highest revenue-generating league in Asia, behind Japan’s J-League (£103m, domestic only). The league’s stated ambition is to generate total revenues of £378m per season. Assuming 10% of this total comes from other revenue sources, £340m in annual broadcast revenues would put the SPL ahead of the MLS and behind Ligue 1 league today.

Attendances

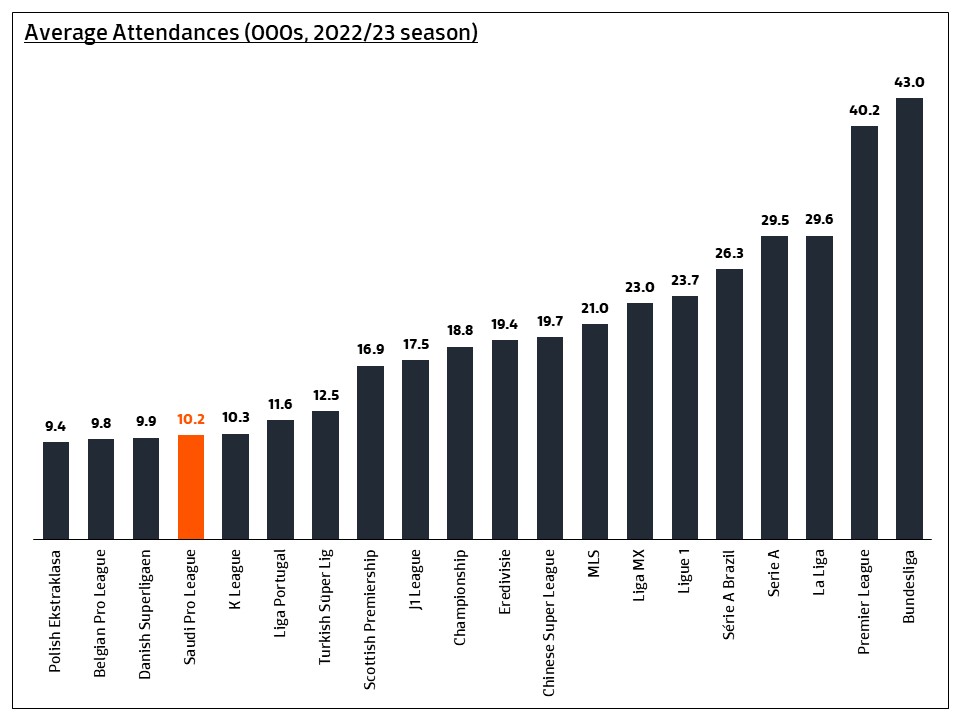

Across the 2022/23 season, the SPL attracted an average attendance of 10,200 which exceeded the Danish Superligaen, Belgian Pro League, and Polish Ekstraklasa. This is despite the relatively limited stadium infrastructure in Saudi Arabia which resulted in Ronaldo playing in front of crowds of less than 10,000 twice last season. The SPL’s current stadiums clearly do not fit the country’s long-term vision to become a global sports powerhouse but it is difficult to see this being an issue for long. With the hosting of the 2027 Asian Cup on the horizon, the Saudi Arabian Football Federation has committed to building three new stadiums and renovating four others prior to that tournament

Improved infrastructure and on-pitch quality are almost certain to drive significant and sustained increases in SPL attendance over the next decade. Full stadiums will also improve the product and make it easier for the league to sell its broadcast rights both domestically and internationally.

On-pitch quality

Prior to the impact of the marquee signings, research from Twenty First Group (TFG) ranked the SPL as the 53rd strongest league in the world and the 3rd strongest in Asia, which is around the level of League One in England. TFG analysis suggests that the best teams would be competitive at the top of the Championship. The quality of the league has since been elevated by the signing of international stars and will continue to rise as further players join in coming transfer windows.

Recent developments in the SPL

To achieve its stated ambition of becoming a top ten global league, the SPL has enacted a dramatic shift of strategy in the last year which can be summarised in 4 key areas:

- Attracting star players

- Restructuring club ownership

- Commercial expansion

- Exploring private equity investment

Attracting star players

Al Nassr’s signing of Ronaldo elevated the SPL’s standing in the global transfer market and established the league as a credible destination for elite, albeit ageing, talent. Karim Benzema, N’golo Kante, Kalidou Koulibaly, Edouard Mendy, and Roberto Firmino have all followed, each earning annual salaries reported to be a multiple of their previous deals in Europe. Ronaldo’s reported salary of £173m5 is far greater than the league’s annual revenues of c.£95m. These star players bring with them a huge social media following which will be crucial to growing awareness and marketing the SPL.

Perhaps the most interesting transfer to date is Ruben Neves’ transfer to Al-Hilal. At 26, Neves is entering the prime of his career and is a starting midfielder for the Portugal national team. Whilst it is the global stars that grab headlines, it is signings like Neves who will deepen the league’s talent pool, improve competitive balance, and add further credibility to the league as a pathway for elite players. Strengthening the overall quality of the league will be essential in addressing the gulf in attendance between the league’s best-attended fixture (59,892 in 2022/23) and worst-attended fixture (284 in 2022/23).

Commercial expansion

The SPL was quick to capitalise on Ronaldo’s signature, employing IMG to secure short-term international broadcast deals for the remainder of the 2022/23 season. After signing deals in 45 countries last season, IMG has been retained to secure further international coverage for the coming season.

International stars have already drawn eyeballs to the SPL, but other strategic moves including the expansion of the league to 18 teams, the entry of foreign investors, and the establishment of a leading commercial team, which already includes experienced media executive Peter Hutton, will be key to attracting broadcasters and sponsors.

Restructuring club ownership

At the start of June, a huge restructuring of the SPL’s ownership was announced. The PIF took 75% stakes in the four largest Saudi clubs (Al Nassr, Al Hilal, Al Ahli, and Al Ittihad) with the remaining 25% of each owned by the clubs’ respective not-for-profit foundations. The ownership of four other clubs, all currently outside of the top division, was passed to other companies backed by the state (Al Qadsia – Aramco, Al Suqoor FC – Neom, Al Diriyah Club – Driyah Gate Development Authority, Al Ula Club – Royal Commission for Al-Ula Governorate). These four clubs will be backed by some of the wealthiest owners in global football. Aramco, for example, is the third largest company globally by market capitalisation, behind only Apple and Microsoft. Each of the eight clubs will now have independent boards and executive management, having previously been owned by the Saudi Ministry of Sport. All other Saudi clubs remain owned by the government department. The backing of PIF and the state-supported companies gives the selected clubs access to a huge pool of capital which can be used to continue to attract international stars to the SPL.

This restructuring also opens up Saudi clubs to the prospect of foreign investment for the first time. The PIF has a history of taking over companies before privatising them (Saudi Grains Organisation, Saudi Medical Service Center) and the long-term aim here is for the PIF and state-linked companies to grow the clubs’ commercial operations and brands before attracting global investors with experience building professional sports teams.

Exploring private equity investment

Seeking private equity investment is another strategy being considered by the SPL to accelerate the league’s growth. Details on this strategy are limited but it is thought that investments in both the league and its clubs are on the table. Recently, private equity firms have been attracted to international properties with large, stable revenue streams like La Liga and Ligue 1 (both have received investment from CVC), but Providence Equity’s 2012 deal to invest in Major League Soccer demonstrates funds’ appetite to explore investments into less-established ‘growth’ leagues. The league will be keen to attract funds with a proven track record in growing global sports properties.

Private equity has also taken an interest in football clubs in recent years, demonstrated by Clearlake’s investment in Chelsea and Redbird’s in AC Milan. There will likely be no shortage of investment interest in the Saudi Pro League and its clubs due to the support of the Saudi government through the PIF and funds’ desire to align themselves with one of the biggest pools of capital in the world.

Funds may have to approach potential investments in the SPL with a long-term perspective that is beyond their typical fund lifecycle of 5-7 years, but there is potentially huge value appreciation upside on offer for those who do.

What does the SPL’s rise mean for global football?

Transfer market and financial sustainability of clubs

The most immediate and noticeable impact of the SPL has been on the player transfer market. The SPL has established itself as a new destination for elite talent and it will continue to acquire players in the coming years, unburdened by the Financial Fair Play regulations faced by teams in European leagues.

One concern across Europe will be that the SPL’s huge outlay on transfers and salaries will drive inflation in the market for players. The £47m6 fee paid by Al-Hilal for Ruben Neves was one of the largest fees ever paid for a player entering the final year of his contract and was highly unlikely to have been matched by any European clubs. It is this second tier of the transfer market, one step below the elite, where transfer fee inflation is expected to be most significant. Many agents will be keenly assessing the opportunities that the SPL could provide their clients, whether this involves a move to the league or using an offer from the league to secure improved deals elsewhere.

Clubs across Europe, many of whom already will struggle to operate without significant losses, will be concerned about the impact of further transfer fee and player salary inflation on their bottom line. With clubs already spending an average of 70-80% of revenue on wages, they have little room for manoeuvre on player costs. UEFA’s planned new Financial Sustainability Regulations which will limit clubs to spending 70% of revenues on transfer fees and wages will likely come under increased pressure as European clubs try to compete with offers for players from Saudi Arabia.

In the short-term, European clubs, such as Chelsea, have taken advantage of this new demand by offloading players to Saudi Arabian clubs. Most of the players that have moved to the SPL so far are in the twilight of their careers. It currently appears unlikely that many players in the prime of their careers and young talents establishing themselves see the SPL as a viable route to achieving their career objectives, although this could change with time.

Whist non-Saudi clubs will benefit financially from the sale of players to the SPL, there is also the risk of a drain of talent as its clubs look to build out their squads. To establish itself as a serious competitor on the global stage in the next 7 years, the SPL will need at least 414 players (18 teams x 23 players). Current SPL regulations limit clubs to 8 overseas players in their squad, which puts a total cap of 144 foreign players in the league. For comparison, there are currently 4017 foreign players playing in the Premier League. The SPL’s overseas player limit thus places heavy a responsibility on the country’s domestic player development system. Whilst improving, the Saudi development system will not be able to supply 270 players at a top-ten league standard in the short term. Twenty First Group estimate that Saudi Arabia’s domestic talent pool is only good for 75th in the world. However, change is happening very quickly at the SPL and there is every chance these limits are relaxed in coming years, increasing the risk of talent drain from European leagues.

International broadcast rights

The SPL joins a select group of leagues with truly global ambitions. Whilst the SPL will do well to compete with the Premier League, La Liga, Serie A, Ligue 1, and the Bundesliga prior to 2030 it is likely to create immediate strategic challenges for smaller leagues. The SPL will use its substantial star power to compete for the rights budgets and timeslots of broadcasters in each market, making the sale of international rights for the leagues below the top tier of leagues more difficult. The challenge many second-tier leagues, and, in time, the four leagues behind the Premier League, face in monetising their products internationally is unlikely to become easier in this market.

The rise of a top-level domestic league in the Middle East will have implications for any league looking to sell its broadcast rights in the region. These markets have become significant markets for the big five leagues. The Premier League’s deal in MENA with BeIN is reported to be worth around £130m8 per season in the current rights cycle. A successful SPL has the potential to become the leading sports property in the Middle East and impact demand for premium overseas rights in the region.

Multi-club ownership

Newcastle United will now have shared ownership with the four Saudi clubs owned by PIF, although it is not thought the clubs will operate in a multi-club network similar to a City Football Group. Even though PIF does not currently appear to be pursuing a multi-club strategy, the global ambitions of the SPL and the opening up to private investment creates opportunities for multi-club ownership groups to expand their networks into the Middle East. The rise of the SPL and UEFA’s recent clampdown on multi-club networks will result in many groups assessing an entry into the Saudi Arabian market. Early investors in the SPL may be able to achieve significant asset value appreciation as the SPL develops its physical infrastructure, commercial capability, and international reputation.

Conclusion

The SPL’s breakthrough on the global stage is changing the balance of the global football ecosystem. This change will create both winners and losers. Smart operators, whether these are leagues, clubs, investors, players, or agents will find ways to benefit from the growth of SPL. Opportunities are already presenting themselves for investors, broadcasters, agencies, and sports service providers to partner with the SPL and benefit commercially.

The SPL remains in the very early stages of its development. It is investing big in talent to drive awareness and generate value but the ambition in the long-term will be to develop a sustainable football ecosystem in Saudi Arabia which becomes core to the country’s outward-facing identity and a potent marketing tool. The SPL has an advantage over other football leagues as it has a clear, centralised strategy that is far removed from the troubles endured by other leagues operating complex stakeholder models.

We have seen plenty of evidence across the sporting landscape that Saudi Arabia’s ambitions in sport should not be underestimated so Oakwell will be taking a close interest when the 2023/24 SPL season kicks off on August 11th.

Oakwell has a deep understanding of the global football ecosystem and can offer financial, strategic, and commercial advice to leagues, clubs and other businesses to help them achieve their long-term objectives. If you can think we can help, or just would like a chat, please reach out to Nic Hamer (nh@oakwellsports.com).

Sources: